You all might have read the announcement by various rating agencies like Moody's and S&P or any other that the Indian stock market is in an overvaluation state and apart from all the talks and things we all kind of agree with it has risen too much to even justify by earnings or other factors. So what could be the cause of this, we can argue there are a lot of new retail investors who are investing in keeping the market going up but in India, Institutional is the big player even in DII's, FII's are a whole different story.

So what could be other justification for this, too much money revolving around this one sounds correct but the question is by how much and by what, to answer this we can look at Yields on Bonds. But why Yield of bonds, the answer to that is assuming there is X amount of money in the world with let's say 4 asset classes where this money can go like Bonds, Equity, Real Estate, and Gold. Now if due to some reasons the bond class is giving less returns than it should have that money allocated to is going to flow to some other source which gives it high returns, think of it like 4 water tanks are connected now if the water in the tank goes high it needs to flow to other tanks to level itself (I will try to attach an illustration made by me hope its good). Now the Money has flowed from bonds to equity which is in discount after the crash the money mostly went here, the real estate also went overvalued soon with gold coming with it.

SO look at the above information and combine it you have multiple sources of returns and the money kept flowing to the one which provided it the highest returns sounds logical there, so that answers our question 2.

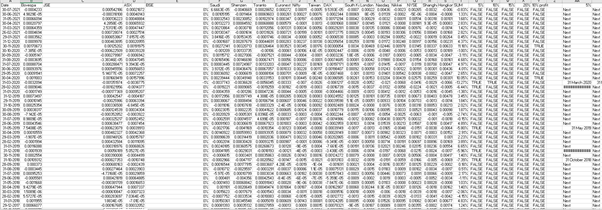

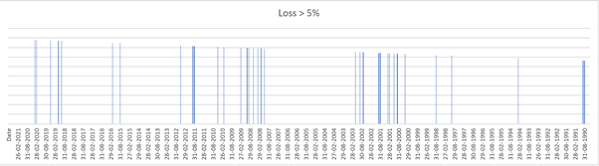

Now coming to question 1 by how much, to answer this I pulled some data from Bloomberg and made a nice line chart to make it easy to understand, so the answer is in the movement of the bond yield and the market p/e, I have used 1-year yield cause that was the only available for 5 years in Bloomberg and also as it is highly liquid. The chart shows an inverse movement between the Yield and Market P/E. So when the yield goes up which means the money is going away out of the market and your P/E also drops. But when the yield drops indicating new money introduced in the market and low return from Bonds so that money goes to the equity side of the market.

As always if you are reading it till here thank you for reading this and if you want the excel file please message me and I will share it, there could be more posts regarding the same topic of the other markets.