Hello, it's been quite a time since ai posted any project-related finance. So here I'm!!

Well, to start I wanted to go big with this one so I WENT BIG!! I wanted to somehow see how the overall world stock exchange performed and how did they perform collectively during a crisis. It was easier said than done, there are so many exchanges around the world like so many.

To start I, first of all, got the list of all exchanges around the world, I wanted to become a little fancy so pulled live data from a trusted source, which gave me all the data about the market cap of all the biggest exchanges of the world.

So I have the initial data to start with, now I wanted to get all the exchanges past data so as a lazy person I went to yahoo finance, no disrespect to it, by the way, it’s a great platform. So I got data of all the exchanges well not all look some exchanges are private they don’t share data for free to anyone, so I had struck me off, and also as I wanted to do this a little quick [YEAH IT ALL GOT DONE REAL QUICK] so I took top 20 exchanges as they had the min market cap of 1 trillion USD at least and that works for me, If you are not happy then sue me!!!!

I will share a yahoo finance snapshot to share the pain 😊[LATER]

So moving forward I got the required data of exchanges but yahoo finance was free so it also has so many blank spots, I cleaned the data for a week using functions like replacing, search, count I did the excel basics on this, to be honest.

After a week still no joy, as the charts were still showing lots of blank spots, and btw the time time period I took was 30 years back starting from 1990, there are older exchanges too but I wanted a common time frame.

So now to the serious part, well none of this was working so I press delete to all of them and went to my good old friend Bloomberg, he gave me all the data I wanted to like all I wanted it was a bit of work but still worth it and I got monthly data of last 30 years.

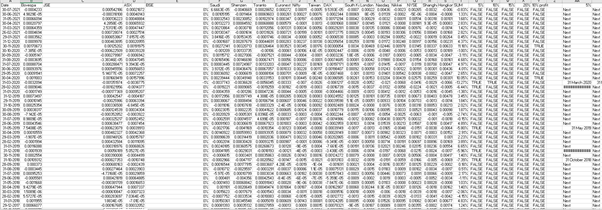

Now first I got the weight of each exchange and there is nothing to be surprised Nasdaq and NYSE got the highest share of all. So I have this data to btw I'm simplifying the process way much than it was, now I have just had to multiply this with stock index value isn’t it NO NO A BIG NO-NO, as each stock have a different base value which gives spotty final value so I need the percentage change to get a correct estimation here, so I did the P0/P0-1 and got the values I multiplied them to the weights of each exchange. [Sharing a snapshot]

Also, as a side note, some stock exchanges had a start date from 2000 but still, they were incorporated to keep consistency.

Now I have got my values and added them to form a single GLOBAL EXCHANGE, so let's start the project now!! Here is the chart I got.

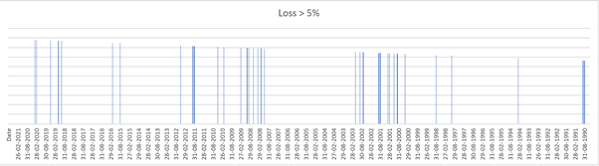

I wanted to check the dips in the global stock exchange, so I had 4 loss values fixed 5%, 10%, 15%, 20%. I used the TRUE== value and IF function to get the dates of losses at each level. Now I just plotted them on charts for each loss level. Here is the pic

Now the google part starts!!

I took each loss date and found what happen and what was the cause for it, the table is given below.

I'm combing all loss values here to provide my observation, so for example the dip in Aug 1990 was due to the gulf and the crude prices jumping, moving to 2000 the dip was caused due to US presidential elections, 1998 Russia defaulted on its bonds, 2001 9/11 happened, 2008 GFC happened, 2011 eurozone crises. The biggest dip of more than 15% was just caused by the financial crises in 2008, even the 2020 crisis was limited to only 10%.

Well, you get the gist of the table now I think.

So apart from this, my observations are:-

1. May and October have been said as the time when the market dips, so that was a big observation.

2. Bonds and Crude, Currency can shake the stock market like anything.

3. Even Fed thinking about rising rates can cause lots of issues.

4. If any Big economy shows a slowdown the whole world just falls!!

5. And yeah beware of US!! That country causes almost half of the crises were caused by them.

6. Finally bubbles always take the entire global stock market down.

7. The dips in the markets are increasing and so is the time period in which they affect they tend to be longer and deeper and much more frequent.

Well, what did I gain from doing this project:-

1. I was always confused about when was Asian crises were, too lazy to look so yes finally I know.

2. I know what now affects the markets, bonds yields are the biggest factors, commodities in which crude is the biggest one to impact the markets, and inflation affect every bit of the market.

A WHOLE LOT MORE BUT THAT’S A SECRET!!

No comments:

Post a Comment