Hello guys,

A quick project I made well I just learned about it too so why not make and share it!!

So it's about the Markowitz portfolio theory, you can search about it on a book or google. I'm not explaining here..

So to make a portfolio from 2 assets the correlation affects the risk that would come up from the entire portfolio, if a portfolio is highly correlated then the risk obviously goes up kinda like leveraging. If the correlation is low then we get diversification benefit from it, and if the correlation is negative the Voila you have reduced the risk more than the individual assets you increase the weight or exposure you get more diversification.

So I wanted to just see how this looks in real life other than book diagrams so I made them. I used my asset correlation matrix to select asset classes.

Positive Correlation Near perfect correlation:-

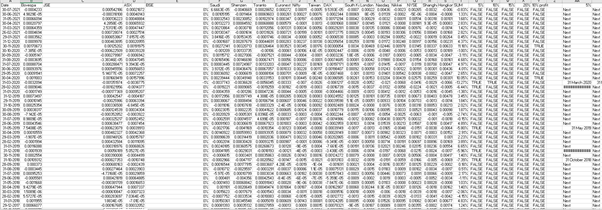

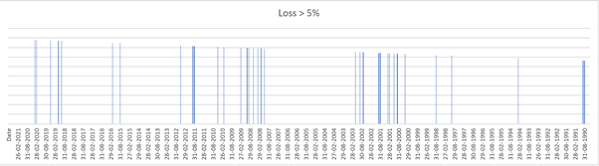

I wanted to use Nifty IT and Nifty as the correlation is .95 but I didn't get enough data on it so I choose a nifty and nifty bank, I took the returns, and SD calculated the portfolio risk and plotted it. The returns are so high and nice here as I didn't actually earlier knew the timeline to pick so I took 10 years monthly returns so these returns are normal over a 10 year period.

So you can see the line is just a straight line which shows in this portfolio as you increase your portfolio weight in this to more risk you get rewarded with higher returns. I have not added any risk-free asset cause you know why..

So here it is, our Global minimum variance portfolio is observed at a return of 35.05% with an SD of 5.114% so yay we achieved diversification, now I need to make the optimal portfolio which depends on utility and other factors so I'm not taking utility here, the theory assumes borrowing and lending happen at the same rate but DOES IT!!!! so as the deposit rates are too low so I'm taking lending rates and for that, I used the most common type of loan an individual can take for doing this and which was personal loans at 24% this is an actual rate take from a bank. by using that I made the tangent line from which touches the point of our optimal portfolio with a return of 35.99% and portfolio risk of 5.137%.

From this what I got is the portfolio offers diversification, correlation matter, and you can make a sweet high yield portfolio with lower risk very easily.

I do want to make a portfolio that not only takes 2 assets but takes the entire universe its a very big project for sure but also fun, and that's why we do this too.

So there it is my small project which took 2 weeks to make and few more days to publish, I will see you later meanwhile I hope your returns are high and your volatility is low, and keep hunting for wild things in this market. Goodbye.